CA SANJAY DEWAN

Monday, 30 June 2014

| Meetings & Minutes - Changes under the Co.Act, 2013 |

BOARD MEETINGS

1. Time limit prescribed for holding first board meeting. First Board meeting to be held within 30 days of incorporation. [Section 173(1)]

2. Minimum number of meetings to be held in a year:

• For OPC, having more than 1 director, small and dormant Company – 2 [Section 173(5)]

• For all other companies – 4 [Section 173(1)]

3. Time Gap between two board meetings

• For OPC, having more than 1 director, small and dormant Company – Not less than 90 days. [Sec 173(5)]

• For all other companies: Not more than 120 days [Sec 173(1)]

4. Board meetings through video conferencing:

• Directors are permitted to attend board meetings through video conferencing and other audio visual means subject to compliance with the rules in this regard.

• Each director has to attend atleast one meeting in person in a year.

• Presence of director in through video conferencing will be counted for the purpose of quorum.

• Approval of Annual Financial Statements and Board's Report cannot be dealt in a meeting held through video conferencing. [Section 173(1) read with relevant rules]

5. Minimum length of notice for Board Meetings prescribed. Atleast 7 days notice in writing needs to be given to all directors, at their addresses registered with the company, by hand deliver, post or by electronic means. Shorter notice is permitted subject to presence of or ratification by atleast 1 independent director, if any. [Section 173(3)]

6. In case of passing of resolution by circulation, where not less than 1/3rd of the total directors require that a resolution under circulation must be decided at a meeting, the chairperson shall put the resolution to be decided at a meeting of the Board. [Section 175(1) proviso].

7. A resolution passed by circulation needs to be noted at subsequent Board meeting and made part of minutes of such meeting. [Section 175(2)]

8. Matters which cannot be transacted though passing of resolution by circulation:

• to make calls on shareholders in respect of money unpaid on their shares [Section 179]

• to authorise buy-back of securities under Sec 68 [Sec 179]

• to issue securities, including debentures, whether in or outside India [Section 179]

• to borrow monies [Section 179]

• to invest the funds of the company [Section 179]

• to sell investments held by the company (other than trade 5% or more of the paid – up share capital and free reserves of the investee company [Section 179]

• to grant loans or give guarantee or provide security in respect of loans [Section 179]

• to approve quarterly, half yearly and annual financial statements and the Board's report [Section 179]

• to diversify the business of the company [Section 179]

• to commence a new business [Section 179]

• to approve amalgamation, merger or reconstruction [Sec 179]

• to take over a company or acquire a controlling or substantial stake in another company [Section 179]

• to appoint a director in casual vacancy [Section 179]

• to make contribution to a political party [Section 179]

• to appoint or remove key managerial personnel (KMP) and senior management personnel one level below the KMP [Section 179]

• to take on record disclosure of interest by directors and shareholding [Section 179]

• to enter into a joint venture or technical or financial collaboration or any collaboration agreement [Sec 179]

• to adopt common seal [Section 179]

• to appoint internal auditors [Section 179]

• to shift the location of a plant or factory or the registered office [Section 179]

• to accept public deposits and related matters [Section 179]

• to enter into any contract or arrangement with a related party (Section 188)

• to appoint and fix remuneration of a Managing Director / Whole Time Director / Manager [Section 196(4)]

• to appointment a person as Managing Director who is already a Managing Director / Manager of one other company [Section 203(3) Proviso]

• to fill vacancy in the office of any whole time Key Managerial Personnel [Section 203(4)]

• to make loans or investment or give security or guarantee [Section 186(5)]

• to make declaration of solvency in case of voluntary winding up (Section 305)

• to place Register of contracts or arrangements in which directors are interested (Sec 189)

General Meetings

1. All provisions relating to general meetings like length of notice, explanatory statement etc. is applicable to private companies also.

2. First Annual General Meeting should be held within 9 months of closure of first financial year. The provision regarding holding first AGM within 18 months from date of incorporation has been done away with. [Section 96(1)]

3. AGM needs to be held during business hours, i.e. between 9.00 A.M. to 6.00 P.M. on any day that is not a National Holiday. [Section 96(2)]

4. In case AGM has to be called at a shorter notice, consent from 95% of the members is required [Sec 101(1) proviso]

5. Notice of every general meeting needs to be served on every director also. [Section 101(3)]

6. In case of an adjourned meeting, the company shall give not less than 3 days notice to the members either individually or by publishing an advertisement in the newspapers (one in English and one in vernacular language) which is in circulation at the place where the registered office of the company is situated.

7. In explanatory statement, nature of concern or interest of every Key Managerial Personnel and their relatives and relatives of directors also need to be disclosed. If the special business relates to any other company, then shareholding of any director or manager in that other company has to be disclosed if the holding is not less than 2% of paid up capital of the other company. [Section 102]

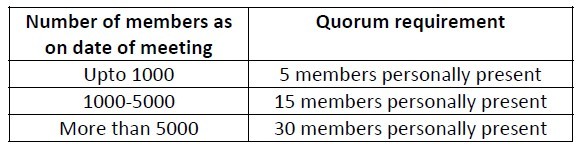

8. Quorum for public companies [Section 103]

9. Proxy:

• In case of companies formed not for profit, a member only can act as proxy for another member.

• No person shall act as proxy on behalf of members not exceeding 50 and holding in the aggregate not more than 10% of the total share capital of the company carrying voting rights.

• Restriction that unless the articles otherwise provide a member of a private company shall not be entitled to appoint more than one proxy to attend on the same occasion has been removed.

10. Voting through electronic means

Every listed company or a company having 1000 or more shareholders shall provide to its members facility to exercise their right to vote at general meetings by electronic means. [Section 108]

11. Postal Ballot

• No postal ballot for Ordinary business

• All items of business on which a director or auditor has right to be heard cannot be transacted through postal ballot.

• A brief report on the postal ballot conducted including the resolution proposed, the result of the voting thereon and the summary of the scrutinizer's report shall be entered in the minutes book of general meetings along with the date of such entry within thirty days from the date of passing of resolution.

• Following items of business can be transacted through postal ballot only, except in case of OPC and companies having less than 200 members:

a. Alteration of objects clause of MOA

b. Alteration of AOA by means of insertion or removal of provisions necessary to constitute a company as a private company in terms of Section 2(68)

c. Change of registered office outside the local limits of any city, town or village as specified in section 12(5).

d. Change in objects for which a company has raised money from public through prospectus and still has any unutilized amount out of the money so raised under section 13(8).

e. Issue of shares with differential rights as to voting or dividend or otherwise under Section 43(a)(ii)

f. Variation in the rights attached to a class of shares or debentures or other securities as specified under sec 48

g. Buy-back of shares by a company under section 68(1)

h. Election of a director under section 151

i. Sale of the whole or substantially the whole of an undertaking of a company as specified under sec 180(1)(a)

j. Giving loans or extending guarantee or providing security in excess of the limit prescribed under Sec 186(3).

Minutes

1. In case of Board and Committee meetings, the minutes shall also contain names of the directors present and names of directors who voted for and against each resolution.

2. Minutes shall not contain any matter which is defamatory to any person, is irrelevant or immaterial or detrimental to the interest of the company. Chairman to exercise discretion in this regard.

3. Secretarial Standards prescribed by ICSI to be observed in preparation of minutes.

4. A member who has made a request for provision of soft copy in respect of minutes of any previous general meetings held during a period of immediately preceding three financial years shall be entitled to be furnished, with the same free of cost.

|

CA SANJAY DEWAN

Major changes in Income Tax Returns for A.Y 2014-15

1. All taxpayers filing E-Returns will have to compulsorily update correct mobile number and E- Mail ID's. Otherwise there will be login issues before uploading of return on income tax Depts Website.

2. Now onwards Income Tax Refund will be issued directly in the bank account of the taxpayer through ECS only, cheques are discontinued. Therefore at most care should be taken while mentioning Bank Account Number and IFSC Code in the income tax returns.

3. From this year while claiming TDS in Income Tax return facility has been given to carry forward the TDS of previous year and brought forward TDS to next year. Due to this reconciliation of TDS claimed on Income and total available TDS as per Form 26 can be made. Tax payers which follow cash system of accounting will be benefited, like Doctors, Advocates, CAs and other professionals.

4. As per newly inserted Section 87A if annual income of the taxpayer is up to Rs. 5,00,000/- then Tax relief of maximum of Rs. 2,000/- is given. For claiming this relief separate space has been inserted in the return.

5. As per newly inserted Section 80EE if taxpayer has purchased house up to Rs. 40 Lakh and taken housing loan of Rs. 25 Lakh then taxpayer can claim deduction of interest up to Rs. 1 Lakh. For claiming this deduction separate space has been inserted in the return.

6. If income of the taxpayer is more than Rs. 1 crore then surcharge of 10% is applicable. For this separate space has been inserted in the return.

7. All salaries taxpayers will now have to give now separate details of LTA (Leave Travel Allowance) and HRA (House Rent Allowance) and other allowances separately. This will help Govt. to track proper claim of such deductions, recent HRA and LTA fallacious claimed by some MPs and Govt. taxpayers may have forced for such changes.

8. From this year the details of short and long term capital gain will have to be given in three parts viz.

a) sale of plot / flat

b) sale of STT paid shares and mutual funds

c) sale of other assets.

Further in case of sale of land or building Stamp Duty Value will have to be mentioned. Further if taxpayer is availing exemption under capital gains then value of newly purchased asset, date of acquisition of the asset and if invested in capital gain account then its details will have to be mentioned.

9. Corporate or LLP assessee will have to mention Corporate Identification Number or LLP Identification Number. Further Director or Designated Partner Identification Number will have to be mentioned. This will help in cross check of information with other legal departments by income tax dept or visa a versa.

10. If assessee carrying on business is taking deduction of bad debts of more than Rs. 1 Lakh of single person, then his PAN will have to be mentioned.

11. As per newly inserted section 43 CA if, taxpayer have sold other than capital assets below stamp duty value (eg. builders / developers) then the difference between the two will be considered as deemed income of the assessee and tax will have to be paid on it. For this separate space has been inserted in the return.

12. If there is more than one owner of the house then, while mentioning details in the schedule of Income from House Property the percentage of co ownership will have to be given.

13. From this year e-filing of wealth tax return is compulsory and in this return the details of all wealth whether taxable or not, will have to be given in depth.

.

.

|

CA SANJAY DEWAN

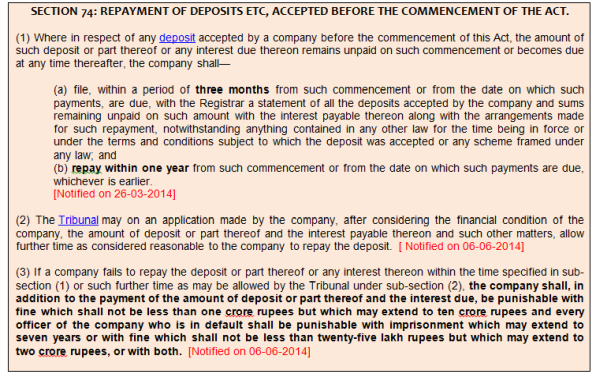

Filing of return of deposits in DPT-4

|

CA SANJAY DEWAN

Filing of Form MBP 1: Interest of directors

| Filing of Form MBP 1: Interest of directors |

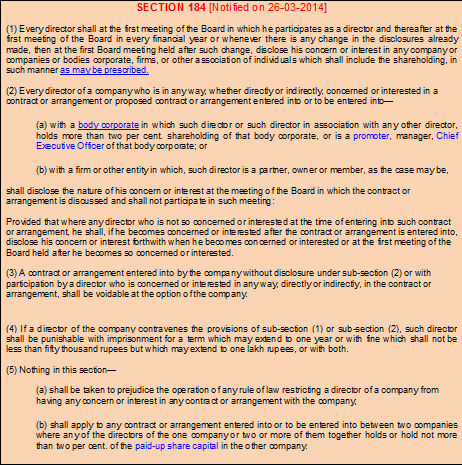

This is one of the important changes that have happened from Companies Act of 1956 (old act) to Companies Act of 2013 (new act). In the old act there was a requirement on the directors to disclose their interest to the company in form 24AA and the same needed to be taken on records by the company in a board meeting.

Similarly in the new act, a director has to disclose interest in form MBP 1 to the company in the first board meeting of the company. Section 184(1) and Rule 9(1) of Companies (Meetings of Board and its Powers) Rules,2014 deal with this requirement.

.png)

DUE DATE FOR FILING: Within 30 days of holding first Board Meeting.

SAVINGS FOR SMALL COMPANY: A Small Company need not get the same attested by a practicing professional, meaning the company can file the form itself.

PROCEDURE:

- Prepare MBP 1 in format notified by the government.

Download from

- Prepare board resolution

RESOLVED FURTHER THAT Mr. Mukesh Gupta, Managing Director of the Company, be and is hereby authorized to make necessary entries in the Registrar maintained for the purpose and to digitally sign and file E-form MGT.14 with the Registrar of Companies, NCT of Delhi and Haryana.

FURTHER RESOLVED THAT Mr. Aman Jain, Practicing Company Secretary, Kolkata be and is hereby authorized to certify and file Form MGT.14 with Registrar of Companies, NCT of Delhi and Haryana and to do such acts, deeds and things as may be considered necessary and appropriate to give effect to the above resolution."

- Take signatures on the above prepared forms and board resolution

- Scan the same and attach with Form MGT 14 and file the same with ROC.

Download form MGT 14 from the following link:

|

CA SANJAY DEWAN

Saturday, 28 June 2014

MCA releases illustrative list of CSR activities; includes salary to CSR staff and excludes exp. on Marathons

MCA releases illustrative list of CSR activities; includes salary to CSR staff and excludes exp. on Marathons

SECTION 135 OF THE COMPANIES ACT, 2013 - CORPORATE SOCIAL RESPONSIBILITY - CLARIFICATIONS WITH REGARD TO PROVISIONS OF CORPORATE SOCIAL RESPONSIBILITY UNDER SECTION 135

GENERAL CIRCULAR NO.21/2014 [NO.05/01/2014-CSR], DATED 18-6-2014

This Ministry has received several references and representation from stakeholders seeking

clarifications on the provisions under Section 135 of the Companies Act, 2013 (herein after

referred as 'the Act') and the Companies (Corporate Social Responsibility Policy) Rules, 2014,

as well as activities to be undertaken as per Schedule VII of the Companies Act, 2013. Clarifications with respect to representations received in the Ministry on Corporate Social Responsibility (hereinafter

referred as ('CSR') are as under:-

clarifications on the provisions under Section 135 of the Companies Act, 2013 (herein after

referred as 'the Act') and the Companies (Corporate Social Responsibility Policy) Rules, 2014,

as well as activities to be undertaken as per Schedule VII of the Companies Act, 2013. Clarifications with respect to representations received in the Ministry on Corporate Social Responsibility (hereinafter

referred as ('CSR') are as under:-

| (i) | The statutory provision and provisions of CSR Rules, 2014, is to ensure that while activities undertaken in pursuance of the CSR policy must be relatable to Schedule VII of the Companies Act 2013, the entries in the said Schedule VII must be interpreted liberally so as to capture the essence of the subjects enumerated in the said Schedule. The items enlisted in the amended Schedule VII of the Act, are broad-based and are intended to cover a wide range of activities as illustratively mentioned in the Annexure. | |

| (ii) | It is further clarified that CSR activities should be undertaken by the companies in project/programme mode [as referred in Rule 4(1) of Companies CSR Rules, 2014]. One-off events such as marathons/awards/ charitable contribution/advertisement/sponsorships of TV programmes etc. would not be qualified as part of CSR expenditure. | |

| (iii) | Expenses incurred by companies for the fulfillment of any Act/ Statute of regulations (such as Labour Laws, Land Acquisition Act etc.) would not count as CSR expenditure under the Companies Act. | |

| (iv) | Salaries paid by the companies to regular CSR staff as well as to volunteers of the companies (in proportion to company's time/hours spent specifically on CSR) can be factored into CSR project cost as part of the CSR expenditure. | |

| (v) | "Any financial year" referred under Sub-Section (1) of Section 135 of the Act read with Rule 3(2) of Companies CSR Rule, 2014, implies 'any of the three preceding financial years'. | |

| (vi) | Expenditure incurred by Foreign Holding Company for CSR activities in India will qualify as CSR spend of the Indian subsidiary if, the CSR expenditures are routed through Indian subsidiaries and if the Indian subsidiary is required to do so as per section 135 of the Act. | |

| (vii) | 'Registered Trust' (as referred in Rule 4(2) of the Companies CSR Rules, 2014) would include Trusts registered under Income Tax Act 1956, for those States where registration of Trust is not mandatory. | |

| (viii) | Contribution to Corpus of a Trust/ society/ section 8 companies etc. will qualify as CSR expenditure as long as (a) the Trust/ society/ section 8 companies etc. is created exclusively for undertaking CSR activities or (b) where the corpus is created exclusively for a purpose directly relatable to a subject covered in Schedule VII of the Act. |

2. This issues with the approval of Competent Authority.

ANNEXURE

| SI. No. | Additional items requested to be included in Schedule VII or to be clarified as already being covered under Schedule VII of the Act | Whether covered under Schedule VII of the Act | ||

| 1. | Promotion of Road Safety through CSR: | (a) | Schedule VII (ii) under "promoting education". | |

| (i) | (a) Promotions of Education, "Educating the Masses and Promotion of Road Safety awareness in all facets of road usage, | (b) | For drivers training etc. Schedule VII (ii) under "vocational skills". | |

| (b) Drivers' training, | (c) | It is establishment functions of Government (cannot be covered). | ||

| (c) Training to enforcement personnel, | (d) Schedule VII (ii) under "promoting education". | |||

| (d) Safety traffic engineering and awareness through print, audio and visual media" should be included. | ||||

| (ii) | Social Business Projects : | (ii) Schedule VII (i) under ' promoting health care including preventive health care.' | ||

| "giving medical and Legal aid, treatment to road accident victims" should be included. | ||||

| 2. | Provisions for aids and appliances to the differently- able persons - 'Request for inclusion | Schedule VII (i) under 'promoting health care including preventive health care.' | ||

| 3. | The company contemplates of setting up ARTIIC (Applied Research Training and Innovation Centre) at Nasik. Centre will cover the following aspects as CSR initiatives for the benefit of the predominately rural farming community: | Item no. (ii) of Schedule VII under the head of "promoting education" and "vocational skills" and "rural development". | ||

| (a) | Capacity building for farmers covering best sustainable farm management practices. | (a) | "Vocational skill" livelihood enhancement projects. | |

| (b) | Training Agriculture Labour on skill development. | (b) | "Vocational skill" | |

| (c) | Doing our own research on the field for individual crops to find out the most cost optimum and Agri-ecological sustainable farm practices. (Applied research) with a focus on water management. | (c) | 'Ecological balance', 'maintaining quality of soil, air and water'. | |

| (d) | To do Product Life Cycle analysis from the soil conservation point of view. | (d) | "Conservation of natural resource" and 'maintaining quality of soil, air and water'. | |

| 4. | To make "Consumer Protection Services" eligible under CSR. (Reference received by Dr. V.G. Patel, Chairman of Consumer Education and Research Centre). |

Consumer education and awareness can be covered under Schedule VII (ii) "promoting education".

| ||

| (i) | Providing effective consumer grievance redressal mechanism. | |||

| (ii) | Protecting consumer's health and safety, sustainable consumption, consumer service, support and complaint resolution. | |||

| (iii) | Consumer protection activities. | |||

| (iv) | Consumer Rights to be mandated. | |||

| (v) |

all consumer protection programs and activities" on the same lines as Rural Development, Education etc.

| |||

| 5. | (a) | Donations to IIM [A] for conservation of buildings and renovation of classrooms would qualify as "promoting education" and hence eligible for compliance of companies with Corporate Social Responsibility. | Conservation and renovation of school buildings and classrooms relates to CSR activities under Schedule VII as "promoting education". | |

| (b) | Donations to IIMA for conservation of buildings and renovation of classrooms would qualify as "protection of national heritage, art and culture, including restoration of buildings and sites of historical importance" and hence eligible for compliance of companies with CSR. | |||

| 6. | Non Academic Technopark TBI not located within an academic Institution but approved and supported by Department of Science and Technology. | Schedule VII (ii) under "promoting education", if approved by Department of Science and Technology. | ||

| 7. | Disaster Relief | Disaster relief can cover wide range of activities that can be appropriately shown under various items listed in Schedule VII. For example, | ||

| (i) | medical aid can be covered under 'promoting health care including preventive health care.' | |||

| (ii) | food supply can be covered under eradicating hunger, poverty and malnutrition. | |||

| (iii) | supply of clean water can be covered under 'sanitation and making available safe drinking water'. | |||

| 8. | Trauma care around highways in case of road accidents. | Under 'health care'. | ||

| 9. | Clarity on "rural development projects" | Any project meant for the development of rural India will be covered under this. | ||

| 10. | Supplementing of Govt. schemes like mid-day meal by corporates through additional nutrition would qualify under Schedule VII. | Yes. Under Schedule VII, item no. (i) under 'poverty and malnutrition'. | ||

| 11. | Research and Studies in the areas specified in Schedule VII. | Yes, under the respective areas of items defined in Schedule VII. Otherwise under 'promoting education'. | ||

| 12. | Capacity building of government officials and elected representatives - both in the area of PPPs and urban infrastructure. | No. | ||

| 13. | Sustainable urban development and urban public transport systems | Not covered. | ||

| 14. | Enabling access to, or improving the delivery of, public health systems be considered under the head "preventive healthcare" or "measures for reducing inequalities faced by socially & economically backward groups"?~ | Can be covered under both the heads of "healthcare" or "measures for reducing inequalities faced by socially & economically backward groups", depending on the context. | ||

| 15. | Likewise, could slum re-development or EWS housing be covered under "measures for reducing inequalities faced by socially & economically backward groups"? | Yes. | ||

| 16. | Renewable energy projects | Under 'Environmental sustainability, ecological balance and conservation of natural resources', | ||

| 17. | (i) | Are the initiatives mentioned in Schedule VII exhaustive? | (i) & (ii) Schedule VII is to be liberally interpreted so as to capture the essence of subjects enumerated in the schedule. | |

| (ii) | In case a company wants to undertake initiatives for the beneficiaries mentioned in Schedule VII, but the activity is not included in Schedule VII, then will it count (as per 2(c)(ii) of the Final Rules, they will count)? | |||

| 18. | US-India Physicians Exchange Program - broadly speaking, this would be program that provides for the professional exchange of physicians between India and the United States. | No. | ||

■■

Subscribe to:

Posts (Atom)